Dual Enrollment 2026: High School College Credits, Financial Impact

Dual enrollment programs in 2026 enable US high school students to earn college credits, offering substantial financial benefits by reducing future tuition costs and accelerating degree completion, significantly impacting long-term educational and economic prospects.

Considering how to get a head start on college while still in high school? Dual enrollment financial impact in 2026 offers an increasingly popular and financially savvy pathway for US students. These programs allow motivated high schoolers to take college-level courses, earning credits that count towards both their high school diploma and a future college degree. This strategic approach not only accelerates academic progress but also presents a significant opportunity to mitigate the escalating costs of higher education, a concern for families nationwide.

Understanding dual enrollment in 2026

Dual enrollment programs, sometimes referred to as concurrent enrollment, have evolved significantly for 2026, becoming more accessible and diverse. These initiatives bridge the gap between secondary and post-secondary education, providing high school students with a taste of college academics. The core idea is simple: take college courses now, apply the credits later, and potentially save a substantial amount of money and time in the long run. This early exposure helps students adapt to college-level rigor and expectations.

In 2026, many states and educational districts are expanding their dual enrollment offerings, making them available to a broader range of students. This expansion often includes online courses, partnerships with local community colleges, and even four-year universities. The goal is to democratize access to these valuable programs, ensuring that students from various socioeconomic backgrounds can benefit.

Program types and accessibility

Dual enrollment programs vary widely, catering to different academic interests and student capabilities. Some programs are highly selective, focusing on advanced placement, while others are designed for broader participation. Accessibility is a key focus in 2026, with efforts to reach underserved communities.

- On-campus college courses: Students attend classes directly at a college campus.

- High school-based college courses: College-level courses taught by qualified high school teachers or adjunct professors at the high school.

- Online dual enrollment: Flexible options for students to take courses remotely.

- Career and technical education (CTE): Programs blending college credits with vocational training.

The flexibility of these options ensures that students can find a program that fits their schedule and learning style. Many programs also offer support services, such as academic advising and tutoring, to help students succeed in their college coursework.

In conclusion, understanding the landscape of dual enrollment in 2026 is the first step toward harnessing its potential. These programs are not just about earning credits; they are about preparing students for college success and offering a pragmatic solution to educational financing.

The direct financial savings of dual enrollment

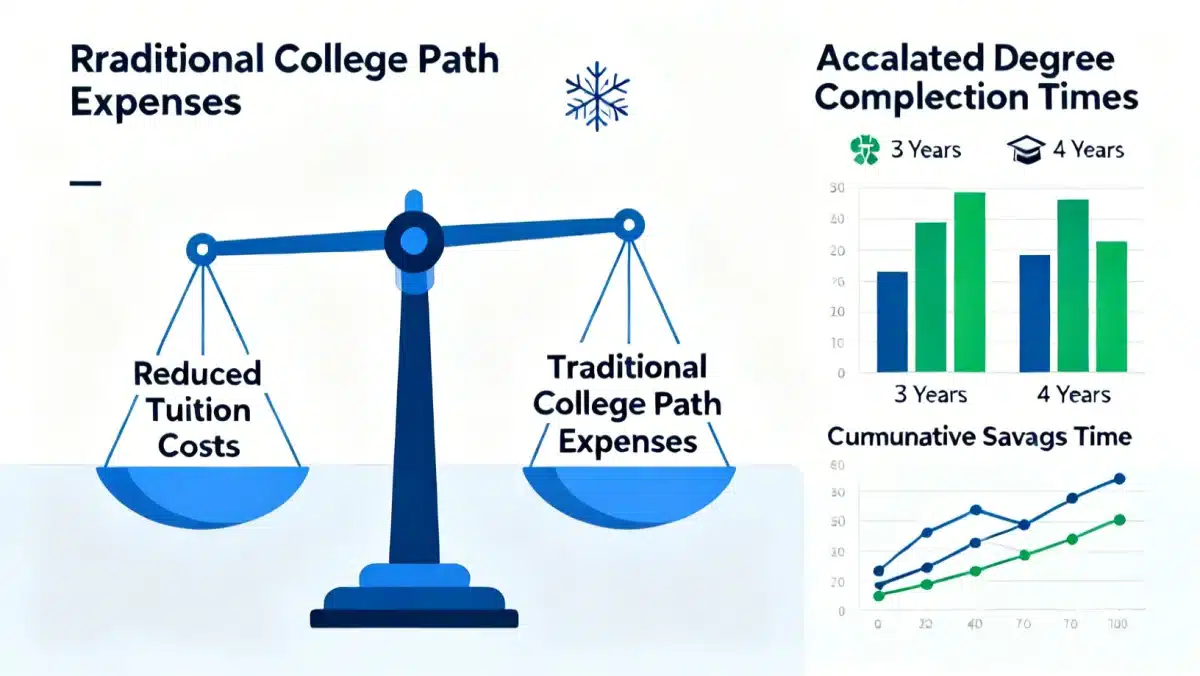

One of the most compelling advantages of dual enrollment programs is the direct financial savings they offer. College tuition and fees continue to rise, making any opportunity to reduce these costs incredibly valuable. By earning college credits while still in high school, students can significantly cut down on the number of courses they need to take, and pay for, once they officially enroll in college. This translates into fewer semesters, lower tuition bills, and potentially less student loan debt.

Consider the average cost of a college credit hour in 2026. While it varies widely by institution and state, even a modest reduction in required credit hours can lead to thousands of dollars in savings. Many dual enrollment programs are offered at a reduced rate, or even free, to high school students, making the financial benefit even more pronounced. These savings can be a game-changer for families struggling to manage college expenses.

Reduced tuition and fees

The most immediate financial benefit comes from avoiding full college tuition rates. Dual enrollment courses are often subsidized by the state, school district, or the college itself. This means students pay significantly less, or nothing at all, for credits that would otherwise cost hundreds, if not thousands, of dollars per course.

- State subsidies: Many states fund dual enrollment, covering tuition costs.

- District partnerships: School districts often partner with colleges to offer courses at no cost to students.

- Community college rates: Even if there’s a cost, community college rates are typically much lower than four-year university rates.

- Textbook and material assistance: Some programs also help cover the cost of textbooks and other course materials.

These financial incentives make dual enrollment an attractive option for families looking to maximize their educational investment. The money saved can then be allocated to other educational expenses, or simply reduce the overall financial burden of a college degree.

In summary, the direct financial savings from dual enrollment are substantial and quantifiable. These programs provide a clear path to reducing the economic strain of higher education, making college more attainable for many students.

Long-term financial benefits and debt reduction

Beyond the immediate savings, dual enrollment programs in 2026 offer significant long-term financial advantages. Completing general education requirements or even a full year of college coursework before graduating high school can shorten the time needed to earn a bachelor’s degree. This acceleration has a ripple effect on personal finances, primarily by reducing the total amount of student loan debt incurred and allowing for an earlier entry into the workforce.

Student loan debt remains a pressing issue for many college graduates in the US. By minimizing the number of semesters a student needs to attend, dual enrollment directly contributes to lowering this debt burden. Graduating earlier also means starting a career sooner, leading to earlier income generation and greater financial independence. This can significantly impact a student’s ability to save, invest, and achieve other financial goals earlier in life.

Accelerated degree completion and career entry

The ability to finish college in three years instead of four, or even two years instead of three for an associate’s degree, is a powerful incentive. This not only saves on tuition but also on living expenses, books, and other associated costs for an additional year of college. The earlier a student can enter their chosen career field, the sooner they start earning a full-time income, repaying any remaining loans, and building financial stability.

- Reduced living expenses: Fewer years in college means less spending on housing, food, and transportation.

- Earlier career launch: Gaining professional experience sooner can lead to faster career advancement and higher lifetime earnings.

- Lower interest accrual: Less time in repayment means less interest accrual on student loans.

- Increased earning potential: A degree completed earlier can lead to earlier access to higher-paying jobs.

These long-term benefits underscore the strategic value of dual enrollment. It’s not just about saving money on tuition; it’s about optimizing a student’s entire financial trajectory from education to career.

In conclusion, dual enrollment’s long-term financial advantages extend far beyond immediate tuition savings, offering a pathway to reduced debt and an accelerated entry into a productive career.

Navigating eligibility and program requirements in 2026

While the financial benefits are clear, understanding the eligibility criteria and program requirements for dual enrollment in 2026 is crucial. Each college and school district may have slightly different standards, but generally, these programs seek academically prepared students who can handle the rigor of college-level work. Early planning and communication with school counselors are essential to ensure a smooth application process and successful participation.

Typical requirements include a minimum GPA, specific course prerequisites, and sometimes placement tests to assess college readiness in subjects like English and math. Furthermore, students often need to demonstrate a certain level of maturity and self-discipline, as college courses demand more independent study and time management than traditional high school classes. Families should research local programs well in advance to understand the specific admissions process.

Key eligibility factors

To qualify for dual enrollment, students usually need to meet several academic and administrative prerequisites. These are put in place to ensure students are prepared for the challenges of college coursework.

- Academic performance: A minimum GPA, often 2.5 or 3.0 on a 4.0 scale.

- Standardized test scores: Some programs may require specific scores on PSAT, SAT, ACT, or college placement exams.

- Counselor recommendation: A recommendation from a high school counselor or administrator.

- Parental consent: Required for students under 18.

- Course prerequisites: Completion of specific high school courses related to the college subject.

It’s also important to consider the student’s overall academic load. Balancing high school commitments with college coursework requires careful planning to avoid burnout. Students should assess their capacity before committing to a dual enrollment program.

Ultimately, navigating dual enrollment requirements successfully involves proactive engagement with school officials and a thorough understanding of what each program demands. This preparation ensures students are set up for academic success.

Potential challenges and considerations

While dual enrollment offers numerous benefits, it’s important to acknowledge potential challenges and considerations. These programs are not a one-size-fits-all solution, and students and families should carefully weigh the pros and cons. Academic rigor, transferability of credits, and social integration are all factors that need careful thought before committing to dual enrollment.

One primary concern is the increased academic pressure. College courses are generally more demanding than high school classes, requiring greater independence, critical thinking, and time management. Students who are not adequately prepared might struggle, potentially impacting their high school GPA or even their confidence. Another crucial aspect is ensuring that the earned credits will actually transfer to the desired four-year institution, as transfer policies vary widely among colleges.

Credit transferability and academic rigor

The transferability of dual enrollment credits is perhaps the most significant potential hurdle. While many public universities readily accept credits from accredited community colleges or other institutions, private universities or out-of-state schools might have stricter policies. It is vital for students to confirm credit transfer policies with their prospective colleges well in advance.

- Research college policies: Verify how specific institutions accept dual enrollment credits.

- Course relevance: Ensure the dual enrollment courses align with future degree requirements.

- Academic preparedness: Assess if the student is truly ready for college-level workload and expectations.

- Impact on GPA: Understand how college grades will affect the student’s overall academic record.

Furthermore, the social aspect of high school can be affected. Students might miss out on certain extracurricular activities or social events if their schedule is heavily weighted with college courses. Balancing academic ambition with a well-rounded high school experience is key.

In summary, while dual enrollment offers incredible opportunities, it demands careful consideration of academic readiness, credit transferability, and the overall impact on a student’s high school experience. Thorough planning can mitigate these challenges effectively.

The future of dual enrollment: 2026 trends and beyond

Looking ahead to 2026 and beyond, dual enrollment programs are poised for continued growth and innovation. Educational institutions and policymakers recognize the immense value these programs offer in terms of college readiness and financial accessibility. We can expect to see further integration of dual enrollment into broader educational strategies, with an increased focus on equity, technology, and career pathways. The landscape of higher education is constantly evolving, and dual enrollment is becoming a cornerstone of future educational models.

Technological advancements will undoubtedly play a larger role, with more sophisticated online learning platforms and virtual reality experiences enhancing the remote dual enrollment experience. There will also be a stronger emphasis on aligning dual enrollment courses with high-demand career fields, ensuring that students are not only earning credits but also gaining skills that are directly applicable to the workforce. This strategic alignment will further amplify the financial and career benefits for participating students.

Emerging trends and policy shifts

Several key trends are shaping the future of dual enrollment, reflecting a commitment to making these programs more effective and accessible. Policy adjustments are often driven by economic needs and educational outcomes.

- Increased state funding: More states are allocating resources to expand dual enrollment access.

- Enhanced career pathways: Greater integration with CTE programs to provide clear career trajectories.

- Focus on equity: Initiatives to ensure students from all backgrounds have equal access to programs.

- Technology integration: Leveraging online platforms and digital tools for flexible learning.

Furthermore, discussions around standardizing credit transfer policies across states and institutions are gaining traction. Such standardization would significantly reduce uncertainty for students and make dual enrollment an even more attractive option nationwide. The ultimate goal is to create a seamless transition from high school to college and career, with dual enrollment serving as a vital bridge.

To conclude, the future of dual enrollment promises continued expansion and refinement, solidifying its role as a critical component of US education in 2026 and for generations to come.

Maximizing dual enrollment for financial advantage

To truly maximize the financial advantages of dual enrollment, students and families must adopt a strategic approach. It’s not enough to simply enroll in courses; careful planning is required to ensure that the credits earned are relevant, transferable, and contribute effectively to the overall goal of reducing college costs and accelerating degree completion. This involves proactive research, communication, and a clear understanding of academic and financial objectives.

One key strategy is to focus on general education requirements, which are typically universal across most college majors and institutions. By completing these foundational courses through dual enrollment, students can significantly reduce their first year or two of college expenses. Additionally, exploring programs that offer free or heavily subsidized tuition can amplify savings. It’s also wise to consider the long-term academic plan and how dual enrollment fits into that vision, ensuring every credit earned serves a purpose.

Strategic course selection and planning

Choosing the right dual enrollment courses is paramount. Students should prioritize courses that fulfill core requirements or align with their intended major to avoid taking unnecessary classes.

- Target general education: Focus on English, math, science, and history courses that are broadly transferable.

- Align with major: Select courses that directly contribute to a specific college major.

- Verify transfer agreements: Confirm with potential colleges how specific dual enrollment credits will be accepted.

- Consult academic advisors: Work closely with high school counselors and college advisors to plan coursework.

Beyond course selection, families should also investigate any available scholarships or financial aid specifically for dual enrollment participants. Some states or colleges offer additional support to make these programs even more accessible and financially beneficial. Proactive engagement with all available resources will ensure the greatest financial return on investment.

In conclusion, maximizing the financial benefits of dual enrollment requires more than just participation; it demands strategic course selection, careful planning, and thorough research to ensure every credit earned translates into tangible savings and an accelerated path to a degree.

| Key Benefit | Description |

|---|---|

| Tuition Savings | Significantly reduces college costs by earning credits at a lower or no cost while in high school. |

| Debt Reduction | Fewer college semesters mean less student loan debt and interest over time. |

| Accelerated Degree | Graduating college earlier allows for quicker entry into the workforce and higher earning potential. |

| College Readiness | Prepares students for college-level rigor, improving academic confidence and transition. |

Frequently asked questions about dual enrollment

Dual enrollment allows high school students to take college courses for both high school and college credit. It saves money because these courses are often free or significantly cheaper than regular college tuition, reducing the total number of credits students need to pay for later in college.

No, transferability is not universally guaranteed. While many public universities accept these credits, it’s crucial to verify the specific transfer policies of your desired colleges and universities before enrolling in dual enrollment courses to ensure they will be accepted.

Requirements typically include a minimum GPA (often 2.5-3.0), specific course prerequisites, and sometimes placement test scores. Students also need to demonstrate maturity and readiness for college-level coursework, which is more demanding than high school classes.

Absolutely. By earning college credits early, students can potentially shorten their time in college, thereby reducing the overall tuition costs and the need for extensive student loans. This directly contributes to a lower debt burden upon graduation.

Students should consider their academic readiness, the transferability of credits to their target colleges, the impact on their high school experience, and their ability to manage a heavier course load. Careful planning with counselors is highly recommended.

Conclusion

Dual enrollment programs in 2026 represent a powerful tool for US high school students seeking to gain a significant advantage in their educational and financial futures. By offering a pathway to earn college credits early, these initiatives not only provide a substantial head start on higher education but also present a strategic solution to the ever-increasing cost of college. The financial impact, ranging from direct tuition savings to reduced student loan debt and earlier career entry, is undeniable. While challenges like credit transferability and academic rigor require careful consideration, proactive planning and informed decision-making can pave the way for a highly rewarding experience. As educational trends continue to evolve, dual enrollment stands out as a vital, accessible, and financially intelligent choice for the next generation of college-bound students.